In 2026, the gap between retail trading and institutional execution has narrowed, not because of simpler indicators, but because of high-fidelity visualisation. To succeed in

today’s environment, a trader must transition from being a chart pattern observer to a

market microstructure analyst.

The following guide outlines the premier order flow execution plan for 2026, emphasising

why Bookmap is the definitive choice for professionals seeking a competitive edge.

1. The Foundation: Market Microstructure Strategy

The primary shift in 2026 is the move away from lagging price action. An effective market

microstructure strategy focuses on the why behind price movement, specifically the

interplay between aggressive market orders and passive limit orders.

Traditional candlestick charts are a post-mortem of what happened. In contrast, Bookmap

provides a live heatmap of the Limit Order Book (LOB), allowing you to see the ‘intent’ of

market participants before a trade even occurs. This transparency is the cornerstone of

modern tape reading methodology. By visualising the depth of market (DOM) at 40 frames

per second, traders can identify where institutional ‘Big Money’ is resting their orders,

creating a map of true support and resistance.

2. Order Flow Execution Plan: The 2026 Workflow

A successful execution plan is no longer about a single signal; it is about the confluence of

three specific data layers.

Layer 1: Liquidity Mapping (The Heatmap)

Before looking for a trade, you must identify where the liquidity and walls are. Using Bookmap, these appear as bright orange or red horizontal lines.

● Genuine Liquidity: Sustained levels that stay on the map as price approaches.

● Spoofing: Large orders that vanish right before price reaches them. Bookmap is

widely regarded as one of the best tools for spotting these traps, as it records the

historical evolution of every limit order.

Layer 2: Aggression Tracking (The Bubbles)

Once price enters a liquidity zone, you look for Volume Bubbles; these represent executed trades.

● Large green bubbles hitting a red liquidity line indicate aggressive buying.

● If the bubbles are large but the price isn’t moving higher, you have found Absorption

at key support/levels.

Layer 3: The Delta Divergence Confirmation

Your final filter is the Cumulative Volume Delta (CVD). In 2026, integrating delta divergence with price action is the primary way to avoid bull traps. If price makes a new

high but your Bookmap CVD is trending lower, the smart money is actually selling into the

retail crowd’s buying.

3. Specification: Advanced Setups for 2026

To rank among the top 1% of traders, you must master these high-probability specifications:

Stacked Imbalance Reversal Setup

This occurs when aggressive market orders overwhelm the opposite side across multiple

consecutive price levels. On a footprint chart, you might see and buy imbalances stacked on top of each other. However, when viewed through Bookmap, you can see if these

imbalances are hitting a massive ‘Iceberg Order’.

VAP (Volume at Price) Scalping

While many use a standard Volume Profile, VAP scalping in 2026 involves watching the

value area; shift in real-time. Professionals look for low volume nodes on the heatmap, as

price tends to traverse these areas rapidly, providing high-RR (Reward-to-Risk) scalping

opportunities.

Absorption and Exhaustion

Online Bookmap reviews frequently highlight the platform’s ability to make absorption

and intuitive. When you see a cluster of large bubbles at a single price level and the price

refuses to break, you are witnessing an institutional player absorbing the float. This is the

most reliable reversal signal in 2026.

4. Why Bookmap is the Industry Leader in 2026

In the world of advanced technical analysis, the tool you use determines the quality of your

data. Bookmap has solidified its position as the tip of the spear; for order flow.

Unmatched Performance and Reviews

When looking at Bookmap reviews across professional forums and Trustpilot in 2026, a few

themes emerge:

Speed: The platform’s ability to process nanosecond-level data updates without lag

is cited as its greatest technical achievement.

Community: The Trader Lab and Discord community are often praised for

providing free, institutional-grade education that turns the steep learning curve into a

manageable journey.

The Best for Transparency: Unlike other platforms that aggregate data, Bookmap

shows the raw, unfiltered depth. Many professional Bookmap reviews state that

once you trade with the heatmap, and standard candles look like trading in the dark.

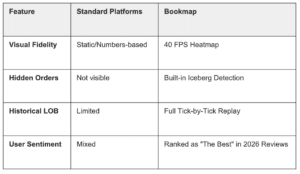

Comparison: Order Flow Platforms 2026 Feature Standard Platforms Bookmap

5. Generalisation: Quantitative and Active Systems

For those looking to scale, order flow isn’t just for manual scalping. It is the foundation of active trading systems and quantitative market analysis.

● Backtesting Order Flow Signals: 2026 traders use Bookmap’s replay function to

‘practice; against historical volatility, treating trading like a flight simulator.

● Multimarket Analysis: Successful strategies now involve watching and correlations.

For instance, watching the S&P 500 futures (ES) liquidity on one Bookmap window

while trading individual tech stocks on another.

6. Conclusion: Preparing for 2026 Volatility

Order flow is the ‘language of the tape’ and Bookmap is the most powerful translator

available. Whether you are focused on bid-ask spread analysis or liquidity-based trading

methods, the key is to stop guessing where support is and start seeing it.

The consensus in 2026 Bookmap reviews is clear: the cost of the platform is an investment

in clarity. In a market dominated by algorithms, seeing the orders before they execute is the only way to stay ahead of the curve.

Your Next Step

Would you like a step-by-step checklist for configuring your first Bookmap workspace specifically for Stacked Imbalance detection?

Mastering Order Flow with Bookmap

This video is essential because it provides a visual walkthrough of the platform’s heatmap and volume bubbles, which are difficult to grasp through text alone.